Remind your team regarding California’s Vehicle License & Registration Fees

The vehicle license fee is the annual fee on the ownership of a registered vehicle in CA in place of a personal property tax. Vehicle licensing fees and registration laws are ever changing in California.

In hopes of giving you an update on where fees currently stand and in order to protect yourselves, we are summarizing parts of California Vehicle Code §9250 regarding registration fees for your reference and for your staff:

Fair Market Value:

According to California Revenue and Taxation Code § 10751, the vehicle license fee is collected upon original registration and registration renewal for automobiles, motorcycles, trailer coaches, park trailers, and commercial vehicles.

Figuring out the vehicle license fee always includes the first step of determining its “fair market value” (FMV). According to California Code, Revenue and Taxation Code § 110, “fair market value” means the amount of cash or its equivalent that property would bring if exposed for sale in the open market under conditions in which neither buyer nor seller could take advantage of the exigencies of the other.

The FMV is determined by the cost to the consumer when the vehicle is sold new or the year the vehicle was transferred to its current owner. The cost price will always include the full purchase price of the vehicle (with accessories and mods included) and is based on the cost price to a new or nonresident vehicle. The cost price does not include tax, smog certificate costs, document fees, prep fees, finance charges, or mods necessary for disabled people to use the vehicle.

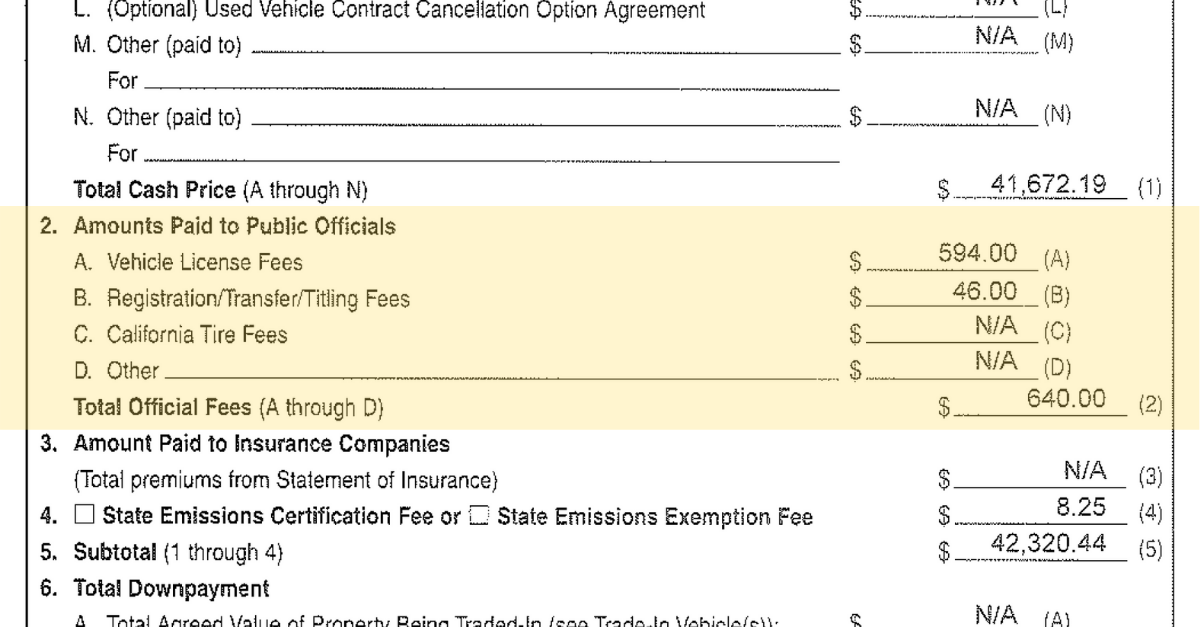

RISC Line 2A:

Based on .65% of the fair market value of the vehicle, on line 2A only. Please be advised the old 2% rate is no longer applicable as of January 1, 2005.

RISC Line 2B:

This is where the title/transfer/registration fees should be listed. These include current registration amounts due, the $15 baseline in registration transfer fees for the used vehicle, CHP fees, and other city & county fees. This amount should be listed on line 2B only, and should never be skipped or listed at zero. Don’t forget, the $15 is a baseline fee and most dealerships always include other applicable taxes.

Mandatory Refunds:

Refunds are MANDATORY. The CA Vehicle Code doesn’t provide a deadline or timing for refunds–state case law views it to be within a reasonable amount of time.

NO Fee-Lumping:

Fee-lumping occurs when the fees are mislabeled and misplaced on lines 2A and 2B. Courts do not view this as a violation to cancel the contract, however, plaintiffs attorneys could still sue under fraud and the CLRA so do not fee-lump.

Vehicle Fee Calculator:

The California DMV have also created a free vehicle fee calculator, which can be located at: https://www.dmv.ca.gov/FeeCalculatorWeb/vlfForm.do

DealerXT is not a law firm or lawyer referral service and cannot provide any advice or opinion about your legal rights. The information found on DealerXT.com is intended for general informational purposes only and should be used only as a starting point for addressing your legal issues. The information is not the provision of legal services, and accessing such information, or corresponding with or asking questions, or otherwise using the Services, does not create an attorney-client relationship between you and DealerXT, or you and any lawyer. It is not a substitute for an in-person or telephonic consultation with a lawyer licensed to practice in your jurisdiction about your specific legal issue, and you should not rely on such Legal Information. You understand that questions and answers or other postings to the Services are not confidential and are not subject to attorney-client privilege. © 2020